TLDR

3 years designing enterprise claims systems and decision infrastructure at Allstate Insurance. Worked in Pivotal-style XP lab using pair design and programming. Key projects: Claims Digital Transformation (modernized intake, reduced filing time to <1 minute), Claims NLP (decision support without automation), Liability Analysis Tool (fault determination with explicit reasoning), Life Sales Central (streamlined underwriting applications).

Challenge: Make mission-critical workflows faster and more consistent without disrupting revenue-critical operations or removing human judgment from high-stakes decisions.

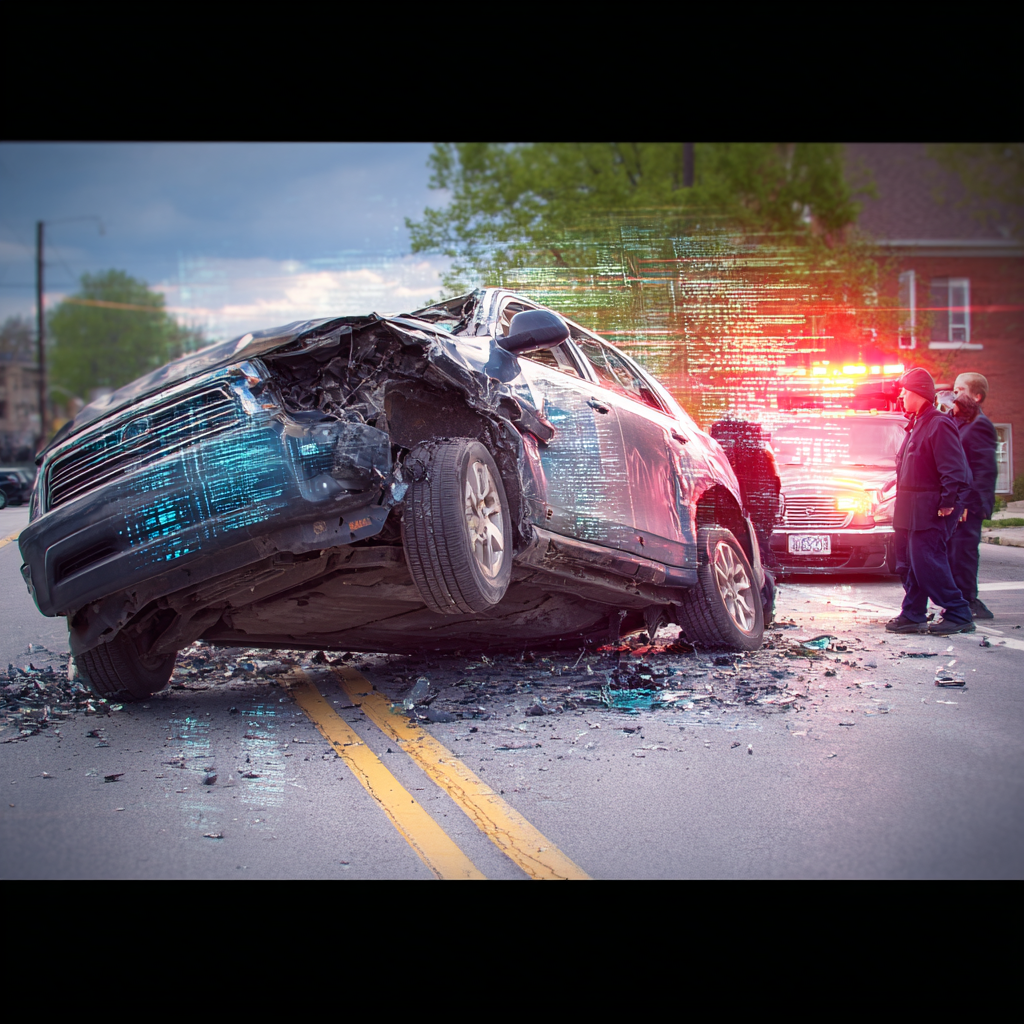

The Insurance Claims Problem

Allstate processes millions of claims annually. Each represents someone’s catastrophic day—they need money for car repairs, property damage, medical bills.

The business stakes:

- 1/3 of customers consider switching carriers after a claim (even when satisfied)

- Customers who filed claims in preceding 2 years: 2x more likely to switch

- People rarely change insurance—until a claim experience makes them reconsider

- Systems are revenue-critical infrastructure—can’t go down

The operational reality:

- Adjusters handle 30+ claims simultaneously

- Call centers manage spikes during catastrophic events

- Underwriters make time-sensitive decisions with incomplete information

- Legacy systems optimized for phone intake and in-person adjusting

- Customer expectations shifted: mobile filing, photo uploads, digital tracking

The design tension: Speed ↔ Verification

Under time pressure with high volume, people skip optional steps and ignore warnings. But insurance requires verification—fraud is real, decisions have financial consequences. How do you make workflows faster without making them careless?

Context:

Worked in Pivotal-style XP (Extreme Programming) lab: pair design, rapid iteration (ship every 2 weeks), cross-functional teams in same space, sustainable pace. This shaped the work—less polishing in isolation, more testing assumptions quickly with real usage.

Strategic goal: make claims experiences good enough that people don’t leave. 74% of insurance customers say they’re more likely to stay with providers offering easy claims processing. Time to settle is highest determinant of satisfaction—higher than settlement amount in some studies.

What I Worked On

Modernizing Intake and Resolution

Problem: Legacy systems built for phone-based intake and in-person adjusting. Customers wanted mobile filing, photo uploads, digital tracking. Systems weren’t bad—worked reliably for decades—but built for different interaction model.

Solution: Designed omnichannel claims flows. Customers start on mobile, finish on web (or vice versa). Mobile-first constraints: small screens, gloved hands (filing in parking lots), poor connectivity.

Design challenges — Partial completion, verification, legacy process mapping

Partial completion: People rarely finish insurance claims in one sitting. System saves progress gracefully, lets people resume.

Verification requirements: Insurance fraud is real. Make it easy for legitimate claimants, harder to game.

Legacy process mapping: Mapped legacy processes into coherent end-to-end journeys. Understood handoffs, data loss points, information repetition requirements.

What changed — Primary channel shift, reduced filing time, faster settlements

Customers filed claims from phones in parking lots immediately post-accident instead of waiting to get home. Claim intake time: several minutes → <1 minute for straightforward claims.

Photos uploaded from phones gave adjusters context before scheduling site visits. Digital flow became primary channel, phone support as backup.

Business impact: faster, simpler process reduced primary reason people switched carriers. Time to settle drives satisfaction more than settlement amount.

Decision Support

The gap: Claims adjusters read years of documentation under time pressure—previous claims, medical records, police reports, damage assessments. 30+ active claims per adjuster.

Approach: Statistical language processing (NLP) surfaced patterns in text—similar past claims, inconsistencies, relevant details. But couldn’t make actual decisions. Required human judgment.

Design decisions: Positioned NLP as assistive support, not automation.

How it worked — Surfaced uncertainty, showed reasoning, prevented over-reliance

Surfaced uncertainty: When model wasn’t confident, said so explicitly rather than presenting weak predictions as facts.

Showed reasoning: Every insight linked back to source documents. Adjusters could verify.

Prevented over-reliance: Interface emphasized adjusters made decisions, not system.

Made bias visible: When model might use problematic patterns, flagged for review.

The design work — Iterating on confidence, similarity, insight presentation

Collaborated with data scientists to understand model outputs. Designed interfaces making outputs useful without misleading.

Iterated on:

- Showing confidence levels without false precision

- Surfacing similar past claims without implying “this is what you should do”

- Presenting model insights alongside human expertise

Impact — Faster processing, reduced handoffs, easier verification

Adjusters processed claims faster because relevant information surfaced automatically. System design prevented shortcuts leading to poor decisions—made verification easier, not optional.

Research: customers speaking to multiple representatives to settle claims significantly more likely to switch carriers. NLP work reduced that friction—gave each adjuster enough context to resolve without handoffs.

Liability Analysis

The situation: Determining fault in auto accidents requires analyzing police reports, photos, witness statements, state traffic laws. Adjusters made these calls dozens of times daily. Variance in decisions created risk—both denying valid claims and paying fraudulent ones.

Design approach: Made reasoning explicit.

How it worked — Structured decisions, state logic, showing math, audit trails

Structured decision trees: Instead of free-form assessment, adjusters answered specific questions about accident conditions.

State-specific logic: Traffic laws vary by state. Tool knew which rules applied where.

Showing the math: Tool calculated liability percentages and explained how it got there.

Audit trails: Every decision documented with reasoning, creating accountability.

Design challenge — Supporting judgment while reducing variance

Worked with senior adjusters understanding how they reasoned about fault. Which details mattered? What made cases ambiguous? When did they override standard logic?

Challenge: support expert judgment while reducing unnecessary variance. Make it easier to apply consistent logic without becoming rigid.

What changed — Consistency, faster training, reduced disputes

Fault determinations more consistent across adjusters. Training new adjusters faster because tool encoded expert knowledge. Appeals and disputes decreased because reasoning was documented and reviewable.

Streamlined Underwriting

The gap: Life insurance applications involved complex underwriting—health history, family medical background, lifestyle factors. Agents collected information through long phone calls, often needing multiple conversations.

Solution: Digital application flows agents could walk through with customers.

Design features — Progressive disclosure, smart branching, validation, status

- Progressive disclosure of complex questions

- Smart branching based on previous answers

- Real-time validation catching errors early

- Clear status indicators showing completion progress

Goal: reduce time to complete applications without sacrificing underwriting thoroughness.

Design Principles That Emerged

Speed ↔ Verification: Under time pressure with high volume, people skip steps. But insurance requires verification. Make critical verifications unavoidable while streamlining everything else.

Decision Support ≠ Automation: Automation removes humans from loop. Decision support makes human judgment faster and better informed. Interface patterns completely different.

High Volume Creates Different Constraints: When adjusters handle 30+ claims simultaneously, every extra click compounds. Small efficiency improvements translate to hours saved per week. Be ruthless about removing unnecessary steps.

Time Pressure Changes Interface Use: Under pressure, people skip optional steps, ignore familiar warnings, develop workarounds. Design must account for this.

Pair Design Surfaces Blind Spots: Another designer watching forces you to articulate reasoning or realize you don’t have any. “Why did you put that button there?” is ruthlessly effective.

What Changed

Claims Digital Transformation:

- Filing time: several minutes → <1 minute for straightforward claims

- Digital channels became primary customer interaction method

- Photo uploads gave adjusters context before site visits

Claims NLP:

- Adjusters processed more claims without longer hours (information surfaced automatically)

- Reduced multi-representative handoffs (primary driver of customer switching)

Liability Analysis Tool:

- More consistent fault determinations across adjusters

- Faster training for new adjusters (encoded expert knowledge)

- Reduced appeals and disputes (documented, reviewable reasoning)

Life Sales Central:

- Reduced application completion time while maintaining underwriting thoroughness

Acknowledgements

Erik Pedersen - my friend and mentor. Thank you for your guidance, support, and for helping me grow as a designer and thinker.

I’m grateful to the many colleagues at Allstate who helped me sharpen my skills and who have become great friends. The collaborative environment and shared commitment to solving hard problems made this work possible.

Technical Environment

Methods: Pair design, rapid iteration (2-week cycles), XP lab embedded, LUMA certified

Collaboration: Product managers, data scientists, business stakeholders, offshore development teams

Tools: Figma, prototyping tools, design systems

Domain: Insurance claims, underwriting, fraud detection, customer service

Scale: Millions of claims annually, 30+ claims per adjuster, catastrophic event spikes